Key information

Publication type: The London Plan

Publication status: Adopted

Publication date:

Contents

Policy E1 Offices

6.1.1 London has a diverse range of office markets[95] with agglomerations of nationally and internationally significant office functions in the Central Activities Zone, Northern Isle of Dogs, Kensington & Chelsea and Tech City, complemented by strategic town centre office locations in inner and outer London and locally-oriented provision in other town centres across the whole of the capital.

6.1.2 The office market is going through a period of restructuring with increasing numbers of micro, small and medium-sized enterprises (SMEs), changing work styles supported by advances in technology, and new forms of accommodation such as flexible and co-working space.[96] Office employment projections suggest an increase of 619,300 jobs, from 1.98 million in 2016 to 2.60 million in 2041, a rise of 31 per cent.[97] This could translate into demand for between 4.7 and 6.1 million sq.m. of office floorspace over the period 2016 to 2041 (Table 6.1). It is important that the planning process does not compromise potential growth and so Table 6.1 provides a broad monitoring benchmark which needs to be set against other drivers such as development trends, employment densities, rents, take-up and vacancy.

Table 6.1 - Projected office employment and floorspace demand 2016-2041

Source: Ramidus Consulting, 2017 (Note: numbers may not sum due to rounding)

6.1.3 The projections indicate that the CAZ boroughs and some parts of inner London will continue to see growth in office employment and development of new office floorspace, driven by agglomeration economies, high value-added activities and viability of new space. There is broadly sufficient capacity to accommodate this demand in the CAZ and Northern Isle of Dogs complemented by Tech City and Kensington & Chelsea, although there are sub-markets within these areas where demand may exceed capacity.[98] Stratford and Old Oak Common are identified as potential future reserves for CAZ-related office capacity.

6.1.4 Outer London will see growth in office employment but the development of significant new office floorspace is anticipated to be focused in selected locations, particularly in west and south London (Figure A1.4) and where values are sufficient to make new office development viable. Office growth in these locations should be supported by improvements to walking, cycling and public transport connectivity and capacity.

6.1.5 It is important to ensure that there is sufficient space to support the growth of new start-up companies and to accommodate SMEs, including lower-cost and affordable business space. Development Plans and development proposals should support the provision of space suitable for SMEs in light of strategic and local assessments of demand and supply.

6.1.6 Outside the office to residential permitted development rights (PDR) exemption areas, more than 1.9 million sq.m. of office space had received prior approval to change to residential by March 2018[99] mostly, but not exclusively, in town centres in west and south London and in areas around the CAZ fringe. There are concerns that office to residential PDR is having disproportionate impacts on occupied office floorspace and on SMEs and that it could undermine the potential to deliver significantly more housing through more intensive forms of mixed-use development, particularly in town centres. This Plan therefore supports boroughs to consult upon and introduce Article 4 Directions for the areas currently exempted in and around the CAZ and for geographically-defined parts of other existing and viable strategic and local office locations, to ensure that their office functions are not undermined by office to residential PDR and to protect local amenity or the wellbeing of an area.

6.1.7 Surplus office space includes sites and/or premises where there is no reasonable prospect of these being used for business purposes. Evidence to demonstrate surplus office space should include strategic and local assessments of demand and supply, and evidence of vacancy and marketing (at market rates suitable for the type, use and size for at least 12 months, or greater if required by a local Development Plan Document). This evidence should be used to inform viability assessments.

Policy E2 Providing suitable business space

6.2.1 The provision of a sufficient supply of business space of different types, uses and sizes will ensure that workspace is available for occupation by SMEs and businesses wishing to start-up or expand. It will also help to ensure that workspace is available at an appropriate range of rents.

6.2.2 Development of business uses should ensure that the space is fit for purpose, with at least basic fit-out, and not compromised in terms of layout, street frontage, floor loading, floor to ceiling heights and servicing, having regard to the type and use of the space. This should take into account the varied operational and servicing requirements of different business uses.

6.2.3 Smaller occupiers and creative businesses are particularly vulnerable and sensitive to even small fluctuations in costs. To support a diverse economy, it is important that cost pressures do not squeeze out smaller businesses, particularly from fringe locations around central London, but also across the capital as a whole. There is evidence that the conversion of occupied or partially-occupied offices to residential use, through permitted development rights, is having a particular impact on secondary space in outer London and on the fringes of the CAZ.[100]

6.2.4 Low-cost business space refers to secondary and tertiary space that is available at open market rents, which is of a lower specification than prime space,[101] or found in non-prime locations such as back-of-town centre and high street locations, railway arches, heritage buildings in the CAZ, and smaller-scale provision in industrial locations. It usually commands rents at or below the market average.

6.2.5 Part B of this policy is intended to operate in those parts of London where there is evidence in a local Development Plan Document of particular shortages of business space available for occupation, including lower-cost space. It supports the life-cycle of prime, secondary and tertiary business space over the longer term by securing the re-provision of capacity at open market rents and the provision of affordable workspace at rents maintained below the market rate where appropriate – (see Policy E3 Affordable workspace). It will be most effective in those parts of London where boroughs have removed office or light industrial to residential permitted development rights through Article 4 Directions.

6.2.6 Larger-scale commercial development proposals should consider the scope to incorporate a range of sizes of business units, including for SMEs. Flexible workspace can include a variety of types of space including serviced offices, co-working space[102] and hybrid industrial space for B1c/B2/B8 uses. What constitutes a reasonable proportion of workspace suitable for SMEs should be determined on the circumstances of each case.

6.2.7 If business space is demonstrated to be obsolete or surplus to requirements (see paragraphs 6.1.7 and 6.7.5), it should be redeveloped for housing and other uses.

Policy E3 Affordable workspace

6.3.1 It is important that London continues to generate a wide range of economic and other opportunities, to ensure that London is a fairer, more inclusive and more equal city. The cost of workspace in London is particularly high relative to other parts of the UK and to ensure that all types of development needed to support the economy can be accommodated there is a need for affordable workspace for some economic, social and cultural uses that cannot afford to operate at open market rents and to support start-up or early stage businesses.

6.3.2 Affordable workspace is defined here as workspace that is provided at rents maintained below the market rate for that space for a specific social, cultural, or economic development purpose. It can be provided and/or managed directly by a dedicated workspace provider, a public, private, charitable or other supporting body; through grant and management arrangements (for example through land trusts); and/or secured in perpetuity or for a period of at least 15 years by planning or other agreements.

6.3.3 Affordable workspace may help support educational outcomes, for example by businesses providing apprenticeships and work experience, offering mentoring by entrepreneurs and/or providing space for further and higher education leavers to develop academic work into businesses. It may also be linked with business support and skills training.

6.3.4 As well as ensuring a sufficient supply of affordable business space, the Mayor also wishes to support sectors that have cultural or social value such as artists, designer-makers, charities, voluntary and community organisations and social enterprises for which low-cost space can be important. Therefore, in certain specific circumstances, as set out in Part A, there may be a need to secure affordable workspace as part of new development.

6.3.5 Social, cultural, or economic development objectives can be set in planning obligations, or by ensuring workspace providers are on a Local Authority framework panel or accredited list. Arrangements for engaging a provider, how the space will be owned or leased and the process for review, changes in terms, disposal or termination, should be agreed with the Local Planning Authority. When drawing up local Development Plan policies, boroughs are encouraged to draw on the experience of local workspace providers to understand the nature of demand in an area. Planning obligations used to secure affordable workspace in mixed use schemes should include mechanisms to ensure its timely delivery. It may be appropriate to require this in advance of some or all residential elements being occupied.

6.3.6 Landowners sometimes provide affordable workspace on a voluntary and temporary basis prior to the redevelopment of a site. This provision makes good use of sites that may otherwise remain vacant. The temporary use of a site should generally be secured through a temporary planning permission and must not result in an unacceptable impact on residential amenity or prevent development sites from being brought forward for development in a timely fashion. Parameters for any temporary use, particularly its longevity and associated obligations, should be established from the outset and agreed by all parties.

6.3.7 The Mayor will encourage the delivery of new workspace for SMEs, the creative industries, artists and the fashion industry within new residential and mixed-use developments. He will also provide assistance to artists and creative businesses through the Mayor’s Creative Enterprise Zones (see Policy HC5 Supporting London’s culture and creative industries) and promote schemes that provide linked affordable housing and affordable workspace in new housing developments.

Policy E4 Land for industry, logistics and services to support London’s economic function

6.4.1 London depends on a wide range of industrial, logistics and related uses that are essential to the functioning of its economy and for servicing the needs of its growing population, as well as contributing towards employment opportunities for Londoners. This includes a diverse range of activities such as food and drink preparation, creative industry production and maker spaces, vehicle maintenance and repair, building trades, construction, waste management including recycling, transport functions, utilities infrastructure, emerging activities (such as data centres, renewable energy generation and clean technology) and an efficient storage and distribution system which can respond to business and consumer demands[104].

6.4.2 Wholesale markets have historically played an important role in London’s economy distributing fresh products to retailers, restaurants and street markets across the capital. Their future role is affected by competition from alternative distribution systems but they are also taking advantage of trends towards increased eating out and are supplying a range of products to London’s diverse communities. This Plan continues to recognise their role whilst enabling opportunities to consolidate composite wholesale markets to meet long-term wholesaling needs.

6.4.3 Industrial land and floorspace provides the capacity for the activities described above to operate effectively. In 2015, London had an estimated 6,976 hectares[105]of land in industrial and related uses of which about 50 per cent was within SILs, a further 14 per cent was in LSIS designated by boroughs and the remaining 36 per cent was in Non-Designated Industrial Sites which are not designated in Local Plan policies maps.

6.4.4 Over the period 2001 to 2015, more than 1,300 hectares of industrial land (including SILs, LSIS and Non-Designated Industrial Sites) was released to other uses. This was well in excess of previously established London Plan monitoring benchmarks.[106] Research for the GLA indicates that there will be positive net demand for industrial land in London over the period 2016 to 2041,[107] mostly driven by strong demand for logistics to service growth in London’s economy and population. The GLA’s assessment indicates that after factoring in both the positive net land demands and the management of vacancy rates, there would be scope to release a further 233 hectares of industrial land over the period 2016 to 2041. However, the demand assessment shows that in 2015, 185 hectares of industrial land already had planning permission to change to non-industrial use and a further 653 hectares were earmarked for potential release in Opportunity Area Planning Frameworks, Local Plans and Housing Zones.

6.4.5 Based upon this evidence, this Plan addresses the need to provide sufficient industrial, logistics and related capacity through its policies.

6.4.6 Where possible, all Boroughs should seek to deliver intensified floorspace capacity in either existing and/or new appropriate locations supported by appropriate evidence.

6.4.7 All boroughs in the Central Services Area should recognise the need to provide essential services to the CAZ and Northern Isle of Dogs and in particular sustainable ‘last mile’ distribution/ logistics, ‘just-in-time’ servicing (such as food service activities, printing, administrative and support services, office supplies, repair and maintenance), waste management and recycling, and land to support transport functions. This should be taken into account when assessing whether substitution is appropriate.

6.4.8 Where industrial land vacancy rates are currently above the London average, boroughs are encouraged to assess whether the release of industrial land for alternative uses is more appropriate if demand cannot support industrial uses in these locations. Boroughs proposing changes through a Local Plan to Green Belt or MOL boundaries (in line with Policy G2 London’s Green Belt and Policy G3 Metropolitan Open Land) to accommodate their London Plan housing target should demonstrate that they have made as much use as possible of suitable brownfield sites and underutilised land, including – in exceptional circumstances – appropriate industrial land in active employment use. Where possible, a substitution approach to alternative locations with higher demand for industrial uses is encouraged.

Policy E5 Strategic Industrial Locations (SIL)

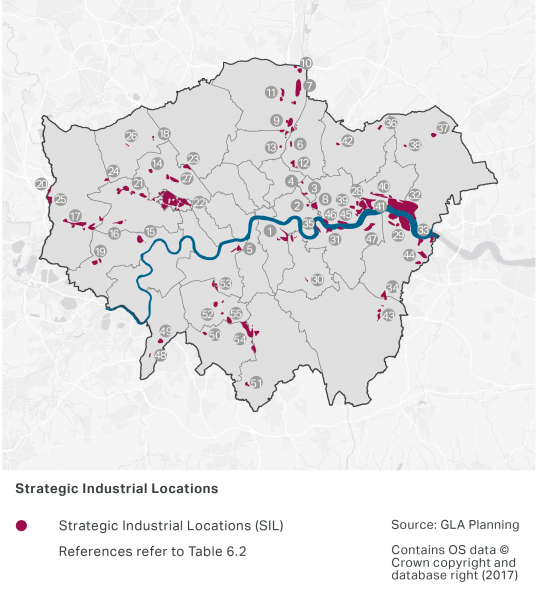

6.5.1 London’s SILs, listed in Table 6.3 and illustrated in Figure 6.2, are the capital’s main reservoir of land for industrial, logistics and related uses. SILs are given strategic protection because they are critical to the effective functioning of London’s economy. They can accommodate activities which - by virtue of their scale, noise, odours, dust, emissions, hours of operation and/or vehicular movements - can raise tensions with other land uses, particularly residential development.

6.5.2 SILs are important in supporting strategic logistics operations serving the capital as well as providing relatively low-cost industrial space for SMEs. Typically, they are located close to the strategic road network and many are also well-located with respect to rail, river, canals and safeguarded wharves which can support the sustainable movement of goods, construction materials and waste to, from and within London. To ensure that London can retain an efficient logistics function it is particularly important to secure and enhance strategic provision in SILs in west London, especially at Park Royal and around Heathrow; in north London in the Upper Lee Valley; in east London, north and south of the Thames; and in the Wandle Valley in south London. This should be complemented by smaller-scale provision in LSIS and Non-Designated Industrial Sites including sustainable ‘last mile’ distribution close to central London.

6.5.3 Innovations to make more effective use of land in SILs are encouraged and should be explored in Local Plan reviews and Opportunity Area Planning Frameworks. This includes collaborative working with other planning authorities in the relevant property market areas including authorities in the Wider South East (see also Policy E7 Industrial intensification, co-location and substitution). This should take into account the potential to rationalise areas of SIL that are currently in non-industrial and related uses or contain transport or utilities uses which are surplus to requirements. The Thames Gateway provides the greatest scope for strategically co-ordinated plan-led consolidation of SILs in order to manage down overall vacancy rates, particularly in the boroughs of Newham and Barking & Dagenham.

Figure 6.1 - Strategic Industrial Locations

Table 6.2 - Strategic Industrial Locations

Policy E6 Locally Significant Industrial Sites

6.6.1 Boroughs may designate locations that have particular local importance for industrial and related functions as Locally Significant Industrial Sites. These designations should be based on evidence in strategic and local demand assessments and should complement provision in SILs. Inner London sites providing sustainable distribution services for the Central Activities Zone and Northern Isle of Dogs may be particularly appropriate for this designation.

Policy E7 Industrial intensification, co-location and substitution

6.7.1 In collaboration with the Mayor, all boroughs are encouraged to explore the potential to intensify industrial activities[108] on industrial land to deliver additional capacity and to consider whether some types of industrial activities (particularly light industrial) could be co-located or mixed with residential and other uses. Through Local Plans, boroughs should also take a proactive approach to the management of vacancy rates to reach a level appropriate to the efficient functioning of the industrial market (considered to be five per cent for land and eight per cent for floorspace).[109]

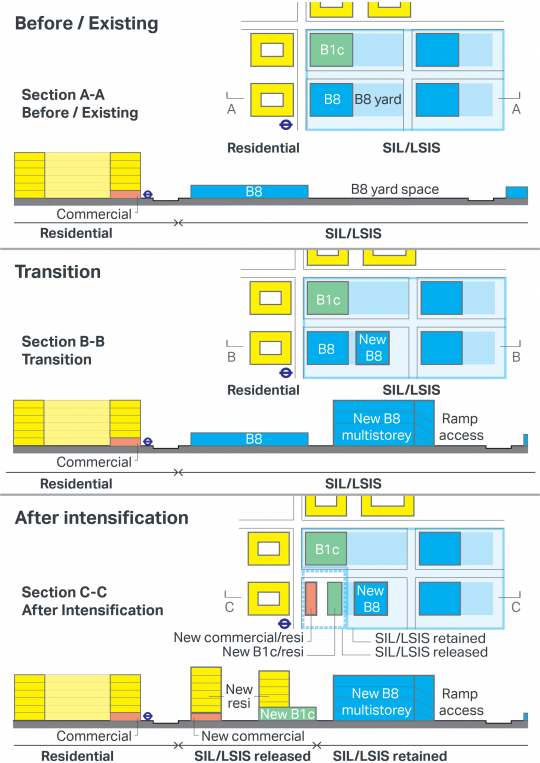

6.7.2 There may be scope for selected parts of SILs or LSISs to be consolidated or appropriately substituted. This should be done through a carefully co-ordinated plan-led approach to deliver an intensification of industrial and related uses in the consolidated SIL or LSIS and facilitate the release of some land for a mix of uses including residential. Local Plan policies’ maps and/or OAPFs and masterplans (as relevant) should indicate clearly:

i. the area to be retained, substituted and/or intensified as SIL or LSIS (and to provide future capacity for the uses set out in Policy E5 Strategic Industrial Locations (SIL) and Policy E6 Locally Significant Industrial Sites) and

ii. the area to be released from SIL or LSIS (see illustrative examples in Figure 6.2). Masterplans should cover the whole of the SIL or LSIS, and should be informed by the operational requirements of existing and potential future businesses.

Figure 6.2 - Strategic Industrial Locations

6.7.3 These approaches may be supported by land swaps within the SIL or LSIS, within the borough or in collaboration with neighbouring authorities. To ensure that such development works effectively, there should be a development agreement in place between the industrial developer and associated (non-industrial) developers.

6.7.4 Outside of areas designated as SIL or LSIS there may be opportunities to deliver co-location involving a mix of industrial and residential and/or other uses on the same site either side-by-side or through vertical stacking.

6.7.5 Evidence to demonstrate ‘no reasonable prospect’ of Non-Designated Industrial Sites being used for industrial and related purposes should include:

- strategic and local assessments of demand

- evidence of vacancy and marketing with appropriate lease terms and at market rates suitable for the type, use and size (for at least 12 months, or greater if required by a local Development Plan Document), and where the premises are derelict or obsolete, offered with the potential for redevelopment to meet the needs of modern industrial users

- evidence that the scope for mixed-use intensification with industrial uses has been explored fully.

6.7.6 There is a significant amount of industrial and logistics capacity serving London that is located outside of the capital.[110] There may be scope for some substitution[111] of London’s industrial capacity to locations in the wider region where this results in mutual advantage, such as complementary business opportunities and transport infrastructure improvements. This will require close collaboration between planning authorities inside and outside London and must ensure that any substitution does not give rise to cumulative negative impacts including, for example, on business supply chains, labour markets, pollution and congestion.[112]

6.7.7 Collaborative working between the Mayor, boroughs and other stakeholders on Development Plan reviews, planning frameworks and masterplans provides useful mechanisms to co-ordinate these processes. This should ensure that the need to maintain sufficient capacity for industry to service London’s economy and residents is considered alongside other planning objectives including delivery of strategic infrastructure, housing, social infrastructure and other uses. Further advice on the implementation of Policy E7 Industrial intensification, co-location and substitution will be provided in Supplementary Planning Guidance,

Policy E8 Sector growth opportunities and clusters

6.8.1 The Mayor wants London to continue to provide the best environment in the world in which to do business, so that businesses of all different sizes and sectors can reach their growth potential. This includes supporting business and employment across all sectors of the economy and capitalising on new growth opportunities in emerging sectors.

6.8.2 This Plan provides the planning framework to complement the Mayor’s Economic Development Strategy (EDS) to ensure that the varied innovation and workspace requirements of London’s businesses are met. This includes the retention and provision of flexible and other forms of workspace to support start-up, existing and growing SMEs. Incubator, accelerator and co-working spaces can provide support and collaboration opportunities for fledgling and growing businesses. Support should meet the requirements of a broad range of SMEs and, in particular, should be tailored to provide opportunities for women and people from BAME backgrounds.

6.8.3 In the EDS, the Mayor has identified a number of sector-specific opportunities and challenges that require a more targeted approach where he believes there are specific business growth opportunities. These include:

- advanced urban services – such as architecture, urban design, planning, engineering, property development, energy and transport. The application of data and new technologies to these disciplines has the potential to make London work better as a city, or ‘smarter’, to become more productive, sustainable and liveable. The Mayor wants London to be a global test-bed for ‘smart city’ solutions, including improving the way people access public services. To support this, he will help to establish common standards for collecting data and make more data open to the public

- culture and creative industries – building on London’s particular strengths in film, fashion and design, with clusters emerging across the city (including Creative Enterprise Zones – see Policy HC5 Supporting London’s culture and creative industries), and the Mayor’s vision to turn the Thames Estuary into a ‘Production Corridor’, developing facilities for artistic and creative production from East London to Southend and into Kent

- financial and business services – sustaining London’s position as a global financial services hub along with a diverse range of professional and business services including legal services, accounting and management consultancy (see Policy E1 Offices)

- life sciences - London, Cambridge and Oxford form the “golden triangle” – a world-leading inter-connected region for life sciences research, development, manufacturing and commercialisation. MedCity – a collaboration between London, Cambridge and Oxford Academic Health Science Centres, co-funded by the Mayor – seeks to promote and grow this life sciences cluster. Development Plans should support the range of existing and proposed medical and life sciences research districts associated with MedCity such as those around the Euston Road (including the Francis Crick Institute, Wellcome Trust and University College Hospital); Imperial College London’s White City Campus; around Whitechapel, associated with Queen Mary University of London; and the London Cancer Hub. Within this sector there is particular demand for affordable ‘grow-on’ space (including laboratory space) to ensure London retains the innovations emerging from London-based universities. The networks and facilities that support London’s role as a centre of medical excellence should also be supported

- low carbon and environmental goods and services sector – building on London’s existing strengths in areas such as carbon finance, geothermal, wind energy, building technologies, alternative fuels, photovoltaics and waste management. The Mayor will support businesses to adopt the principles of the circular economy as set out in Policy SI 7 Reducing waste and supporting the circular economy. The Mayor will also support the growth of London’s CleanTech sector across London. West London in particular offers a unique set of opportunities to support the growth of this sector, with the development of a major innovation campus by Imperial College London at White City, and the simultaneous redevelopment of Old Oak and Park Royal into a smart and sustainable district

- tech and digital sector – which supports the growth and evolution of all sectors in the economy. Planning should ensure that new developments have the digital connectivity required to support London’s global competitiveness (see Policy SI 6 Digital connectivity infrastructure). In the City Fringe, the Tech City cluster should be supported as one of London’s nationally-significant office locations and complemented by Development Plan policies to enable entrepreneurs to locate and expand there and to provide the flexibility and range of space that this sector needs, including affordable space. The Mayor will support the growth of the tech and digital sector across all of London

- tourism – which gives London an international profile – attracting people from across the world – and showcases London as a diverse and open city (see also Policy E10 Visitor infrastructure).

6.8.4 The Mayor also supports measures to secure and develop London’s leading role as a centre of higher and further education of national and international importance. London’s higher and further education providers have considerable potential for innovation supported by collaboration between businesses, the public sector and other relevant research organisations. These initiatives can act as a catalyst for economic growth and promote social mobility in areas with high levels of deprivation by creating new jobs and training opportunities for local residents, as well as supporting the growth of emerging sectors in London. The Mayor will support higher and further education providers and boroughs to identify opportunities to work in partnership to benefit from the development of higher and further education facilities.

6.8.5 The Strategic Outer London Development Centre (SOLDC) concept seeks to support the growth of business and employment opportunities beyond central London. This involves realising the potential of such locations to develop their specialist economic growth in ways which will help achieve the Mayor’s wider objectives. Town centres offer particular advantages for some specialist activities but the SOLDC concept can apply to a range of business locations including industrial areas. The approach is designed to encourage local innovation whilst ensuring that it supports and complements the economic prospects of neighbouring town centres including those in adjacent boroughs.

6.8.6 Implementation of the SOLDC concept will involve actions from a range of partners in light of local circumstances on matters including (but not exclusive to):

- Development Plans and frameworks (including Opportunity Area Planning Frameworks, local Area Action Plans and Town Centre strategies)

- strategic infrastructure plans

- new development and refurbishment

- public transport connectivity and capacity upgrades

- other infrastructure

- management and investment (including Business Improvement Districts)

- improvements to the business environment and public realm

- promotion, branding and marketing.

6.8.7 Boroughs across London contain a rich variety of employment areas, including industrial estates, high streets and areas within and on the edge of town centres, which provide locations and opportunities for locally significant sectors and clusters of businesses. These are important for local economies and provide diverse employment opportunities for local residents. Boroughs are encouraged to identify these sectors and clusters and set out policies in Local Plans that support their growth, having regard in particular to public transport provision and ensuring the vitality and viability of town centres.

Policy E9 Retail, markets and hot food takeaways

6.9.1 A diverse and competitive retail sector that meets the needs of Londoners and visitors to the capital is important. Retailing is undergoing restructuring in response to recent trends and future forecasts for consumer expenditure, population growth, technological advances and changes in consumer behaviour, with increasing proportions of spending made via the internet. As a result, retailing has evolved to become multi-channel, with a mix of physical stores, often supported by internet ‘click and collect’ in store or deliveries to homes, workplaces or pick-up points, and in other cases purely online businesses with no physical stores.

6.9.2 Taking into account projected growth in household, commuter and tourist spending in London, retailers making more efficient use of existing space and special forms of trading (which includes internet-related spend), it is estimated that London could have a baseline need for additional comparison goods retailing of around 1.6 million sq.m. over the period 2016-2041, or 1.2 million sq.m. when current schemes in the planning pipeline are taken into account.[113]

6.9.3 In preparing or reviewing Development Plans, boroughs should take into account integrated strategic and local assessments of demand and capacity for both comparison and convenience goods retailing. Boroughs should plan proactively to accommodate that demand and manage the transition of surplus retail (including high street frontages, purpose-built shopping centres, malls and retail parks) to other uses in line with this policy and Policy SD6 Town centres and high streets, Policy SD8 Town centre network, Policy SD7 Town centres: development principles and Development Plan Documents, while ensuring sufficient capacity for convenience retail to meet the day-to-day needs of local residents.

6.9.4 Street markets in London can play a valuable economic, social and cultural role[114] helping to meet Londoners’ varied dietary requirements, extend choice and access to a range of goods, contribute to the vitality and viability of town centres and the character of high streets, and provide opportunities for new businesses to start-up. Several markets are of strategic importance, such as those at Portobello Road, Borough, Columbia Road and Camden for example, and offer significant attractions for Londoners and visitors to the capital. Many markets have a specialist function, serving the shopping and leisure needs of a specific ethnic group, or providing speciality products and services. Whilst the planning system can help support the range of London’s markets, broader actions are often required in terms of management and investment. The Mayor has established the London Markets Board to help ensure that markets continue to flourish, support growth in town centres and associated high streets, and remain vibrant attractions for all Londoners and visitors to the capital.

6.9.5 Policy SD6 Town centres and high streets promotes a diverse range of uses to support the vitality and viability of town centres. Some retail and related uses when clustered can support town centres to develop niche or specialist roles and may provide important visitor attractions. Over-concentrations of some uses however, such as betting shops, pawnbrokers, pay-day loan stores, amusement centres and hot food takeaways, can give rise to particular concerns regarding the impact on mental and physical health and wellbeing, amenity, vitality, viability and diversity. The proliferation and concentration of these uses should be carefully managed through Development Plans and planning decisions, particularly in town centres that are within Strategic Areas for Regeneration (see Table A1.1), which tend to have higher numbers of these premises.[115] Boroughs may require Health Impact Assessments for particular uses.

6.9.6 Obesity is one of the greatest health challenges facing the capital. In London 38 per cent of Year 6 pupils (10 to 11 year-olds) are overweight or obese – higher than any other region in England. Children living in the most deprived areas of London are twice as likely to be obese as children living in the least deprived areas.[116] The creation of a healthy food environment, including access to fresh food, is therefore important. The number of hot food takeaways in London has been steadily rising, with London boroughs having some of the highest densities of hot food takeaways in England. More deprived areas commonly have a higher density of hot food takeaways than other areas.[117]

6.9.7 Hot food takeaways generally sell food that is high in calories, fat, salt and sugar, and low in fibre, fruit and vegetables. There is evidence that regular consumption of energy-dense food from hot food takeaways is associated with weight gain, and that takeaway food is appealing to children. It is recognised that the causes of obesity are complex and the result of a number of factors, and that a broad package of measures is required to reduce childhood obesity within London. A wide range of health experts recommend restricting the proliferation of hot food takeaways, particularly around schools, in order to help create a healthier food environment. Boroughs wishing to set a locally-determined boundary from schools should justify this using evidence provided by public health leads. Shift and night-time workers also find it particularly difficult to access healthy food due to the limited options available to them at night time.

6.9.8 The Healthier Catering Commitment[118] is a scheme that helps food businesses in London to provide healthier food to their customers. The scheme promotes a reduction in the consumption of fat, salt and sugar, and an increase in access to fruit and vegetables. This can also help ensure there are healthier food options available for night workers.

6.9.9 Commercial activity provides opportunities for micro, small and medium-sized enterprises to establish and contribute to the diversity of town centres. Independent businesses, including shops, cafés and restaurants, play an important role in supporting the vitality and vibrancy of town centres and local communities, and many operate from smaller premises. In parts of London, small shops and other A Class uses suitable for occupation by SMEs may be in short supply and affordability can be a key concern. Larger developments that include a significant amount of commercial floorspace can contribute to the diversity, vitality and vibrancy of town centres by providing a range of unit sizes that includes smaller premises. The High Streets for All report found that almost 70 per cent of small businesses consider rent unaffordable[119] with average retail rents increasing 4 per cent per annum over the period 2009 to 2016.[120] Where there is local evidence of need, Development Plans should require affordable commercial and shop units (secured through planning conditions or planning obligations as appropriate).

Policy E10 Visitor infrastructure

6.10.1 London is the second most visited city in the world and the Mayor wants to spread economic and regeneration benefits by working with London & Partners to promote tourism across the whole of the city, including outside central London. This Plan supports the enhancement and extension of London’s attractions particularly to town centres and well-connected parts of outer London, complemented by supporting infrastructure including visitor accommodation, a high-quality public realm, public toilets and measures to promote access by walking, cycling and public transport.

6.10.2 Given the importance of tourism to London’s economy, London needs to ensure that it is able to meet the accommodation demands of tourists who want to visit the capital. It is estimated that London will need to build an additional 58,000 bedrooms of serviced accommodation by 2041, which is an average of 2,230 bedrooms per annum.[125] In addition to leisure visitors the needs of business visitors require consideration, including provision of suitable facilities for meetings, conferences and exhibitions in both hotels and purpose-built convention and exhibition centres.

6.10.3 Boroughs in the CAZ are encouraged to direct strategically-significant serviced accommodation (defined as more than 20,000 sq.m. in the CAZ) towards the CAZ Opportunity Areas. Concentrations of serviced accommodation within parts of the CAZ that might constrain other important strategic activities and land uses (for example offices and other commercial, cultural and leisure uses) or erode the mixed-use character of an area should be avoided. Boroughs in outer and inner London beyond the CAZ are encouraged to plan proactively for new serviced accommodation in town centres to help spread the benefits of tourism to the whole of the capital.

6.10.4 Improving the availability of accessible serviced accommodation[126] is vital to ensuring that as many visitors as possible can stay in London and experience its visitor attractions and business offer. To help achieve this, serviced accommodation developments should achieve the highest standards of accessible and inclusive design (see also Policy D5 Inclusive design). The policy requirement provides two options and developers can choose the option which best fits the scale of development proposed. These requirements aim to recognise the need not only for standard wheelchair accessible rooms, but also rooms suitable for people with ambulant mobility impairments or older people who could benefit from additional access features, as well as rooms suitable for people who require assistance or need to be near to a carer.

Policy E11 Skills and opportunities for all

6.11.1 London has a strong, dynamic, global economy, but despite the capital’s economic growth and prosperity, the employment rate has lagged behind the national average for three decades. More than 270,000 Londoners are unemployed, with particularly high rates of youth unemployment. Employment rates in London are consistently lower for those without any formal qualifications. London also has a growing problem of in-work poverty, associated with low-skilled low-paid work. Ensuring an effective and responsive skills system is critical to tackling these issues, enabling more Londoners to find and progress in work and support strategic and local regeneration.

6.11.2 Developers are often required to make employment and training opportunities in new developments available to local residents as part of Section 106 planning agreements. While there are examples of this approach working well, by ensuring that developers make a direct, positive contribution to the local communities in which they are working, the current model does not always succeed in enabling residents to complete their training, securing sustainable employment for local people or meeting the demand for construction skills.

6.11.3 Employment and training targets included in Section 106 agreements are often based on the number of new apprenticeship or training starts, rather than the meaningful completion of these. The often short-term nature of construction projects compared to the longer duration of apprenticeships mean that apprentices employed at the beginning of a project may not have finished their training by the time construction on site is completed. This means that once developments finish, apprentices may not be able to move with contractors to developments in different areas (because they too will have their own local labour requirements and requirements for new training and employment starts). They may therefore, be unable to complete their training. In addition, local labour requirements can mean that contractors struggle to meet the demand for skills because they must source labour from a geographically-defined labour pool, where the required skills may not necessarily be available.

6.11.4 Cross-borough working, co-ordination and sharing of data on employment and training opportunities, together with a more uniform approach to the drafting of Section 106 obligations across the capital, could help deliver more successful employment outcomes and ensure that the objectives in Part B can be achieved. The GLA is keen to support this approach and, as recommended by the Mayor’s Homes for Londoners Construction Skills Sub-Group, will investigate how best to do this, recognising that there is a need to demonstrate that any new approach improves outcomes for employers, boroughs and residents. This new approach should provide more meaningful employment and training opportunities for residents across London, while recognising the importance of new developments for providing local employment opportunities. Successful implementation of this approach should ensure that employment and apprenticeship opportunities created by developments are taken up and completed by a greater number of Londoners.

[95] Offices include uses falling within Use Class B1a and office-related B1b.

[96] London Office Policy Review, Ramidus Consulting, 2017; Supporting places of work: incubators, accelerators, co-working spaces, URS, Ramidus, #1Seed and Gort Scott, 2014

[97] Ramidus Consulting, 2017 op cit

[98] London Employment Sites Database, CAG Consulting, 2017 and Ramidus 2017 op cit..

[99] London Development Database

[100] Ramidus Consulting, 2017 op cit / London Development Database monitoring

[101] See Glossary for definitions of Prime, secondary and tertiary commercial property

[102] Ramidus Consulting, 2017 op cit section 2.3

[103] Sites containing industrial and related functions that are not formally designated as SIL or LSIS in a Local Plan

[104] Keep London Working, SEGRO, 2017, [https://www.turley.co.uk/comment/report-keep-london-working]; Industrial Revolution, Turley, 2017, https://www.turley.co.uk/comment/industrial-revolution

[105] London Industrial Land Supply and Economy Study, AECOM, 2016

[106] AECOM, 2016 op. cit.

[107] London Industrial Land Demand Study, CAG Consultants, 2017

[108] Industrial Intensification Primer, GLA, 2017; London Industrial Land Demand Study, CAG Consultants, 2017

[109] London Industrial Land Demand Study, CAG Consultants, 2017; Land for Industry and Transport SPG, GLA, 2012

[110] AECOM 2016, op. cit.

[111] The term ‘substitution’ refers here to making provision of land and floorspace to accommodate business uses in alternative locations outside London to meet projected future demand.

[112] London Industrial Land Demand Study, CAG Consultants, 2017; Industrial Land and Transport Study, Peter Brett Associates, 2017

[113] Experian, 2017 op cit.

[114] Understanding London’s Markets, GLA, 2017

[115] London Town Centre Health Check, GLA, 2018

[116] From Evidence into Action: Opportunities to Protect and Improve the Nation’s Health. Public Health England, Oct. 2014, https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/366852/PHE_Priorities.pdf

[117] Fast Food Map. Public Health England, 2016, https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/578041/Fast_food_map_2016.pdf

[118] The Healthier Catering Commitment, https://www.london.gov.uk/what-we-do/business-and-economy/food/our-projects-food-london/healthier-catering-commitment

[119] High Streets for All, GLA, 2017

[120] London Town Centre Health Check, GLA, 2017

[121] Figure 52 illustrates an example of an accessible bedroom with en-suite sanitary facilities

[122] Figure 30 illustrates requirements for a wheelchair accessible en-suite shower room with corner WC for independent use

[123] Figure 33 illustrates requirements for a bathroom for independent use incorporating a corner WC layout

[124] 19.2.1.2 of BS8300-2:2018 specifies design and percentage requirements for accessible bedrooms including wheelchair accessible rooms with an en-suite shower room for independent use, rooms with a tracked hoist system and a connecting door to an adjoining (standard) bedroom for use by an assistant or companion, rooms with an en-suite shower room to meet the requirements of people with ambulant mobility impairments, and rooms large enough for easy adaptation to wheelchair accessible bedroom standards that are structurally capable of having grab rails installed quickly and easily.

[125] Working Paper 88, Projections of demand and supply for visitor accommodation in London to 2050, GLA Economics, 2017, https://www.london.gov.uk/sites/default/files/visitor_accommodation_-_working_paper_88.pdf

[126] Working Paper 90, Projections of demand and supply for accessible hotel bedrooms in London, GLA Economics, 2017, https://www.london.gov.uk/sites/default/files/accessible-hotel-rooms-wp90.pdf